- This topic has 0 replies, 1 voice, and was last updated 1 year, 3 months ago by .

Investment Scams

Reported On November 13, 2024 at 12:07 pm

Avoiding Crypto Traps: Lessons from the QDD-Finance.com Fraud Scheme

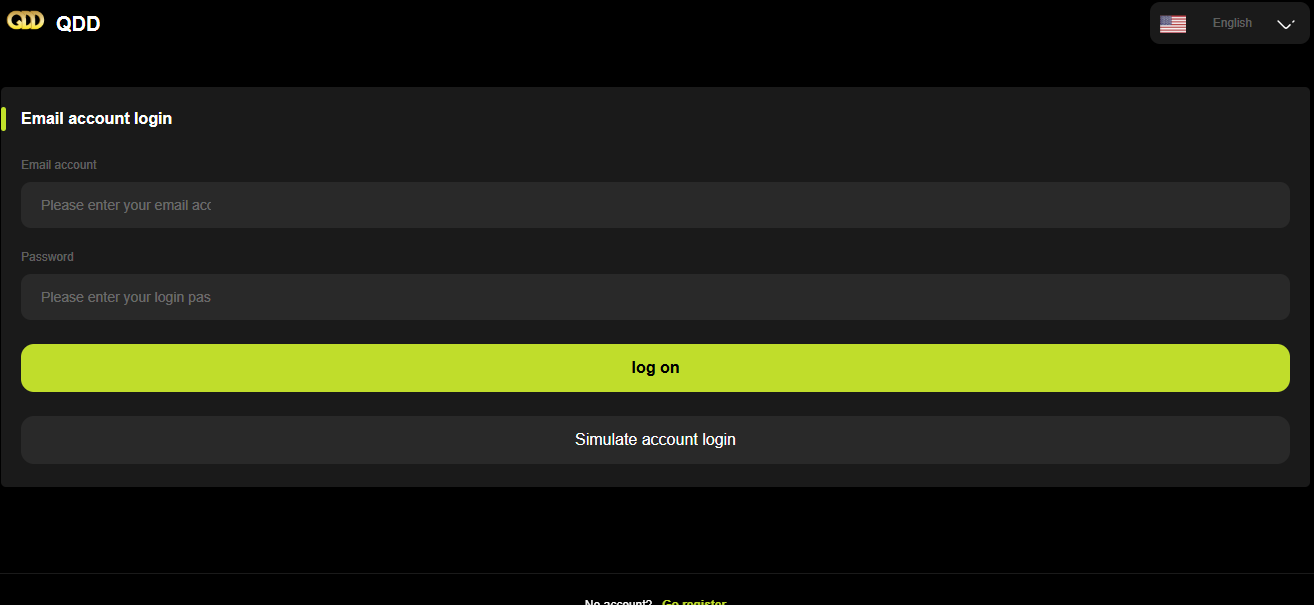

In recent months, cryptocurrency investors have raised concerns about a potential scam linked to qdd-finance.com, a platform claiming to offer high-yield crypto investments. By examining the site’s operational tactics, transactional history, and domain information, it becomes evident that qdd-finance.com is designed to exploit investor trust and siphon off their funds under false pretenses.

In recent months, cryptocurrency investors have raised concerns about a potential scam linked to qdd-finance.com, a platform claiming to offer high-yield crypto investments. By examining the site’s operational tactics, transactional history, and domain information, it becomes evident that qdd-finance.com is designed to exploit investor trust and siphon off their funds under false pretenses.- How QDD-Finance.com Operates

The qdd-finance.com scheme begins by leveraging social media platforms to lure investors through ads promising lucrative returns. These ads often mimic reputable investment opportunities, targeting individuals seeking fast profits. Upon visiting the site, investors encounter a sleek, professional interface, complete with seemingly legitimate affiliations to established financial institutions. - The process typically involves the following steps:

- Registration and Tiers: New users are required to register, after which they are presented with various investment “tiers” or packages, each with promises of substantial returns based on AI-driven trading algorithms.

Deposits and Wallet Details: Users are prompted to send cryptocurrency to specified wallet addresses. For instance, in this case, receiving address

has reportedly received 44.50423 ETH, 1.9997 USDC, and 43,640.683302 USDT—amounts reflecting significant investments that users believed were secure. 0x7370FD9ec17E459eb99F4C25e5C6bffa3952f4FB

0x7370FD9ec17E459eb99F4C25e5C6bffa3952f4FB

Tactics Used to Deceive Investors

Once funds are transferred, qdd-finance.com employs several manipulative tactics to retain control of the assets: - Blocked Withdrawals: When users attempt to withdraw their funds or profits, their requests are often blocked. Customer support—available only through Telegram—then tells users they must either recruit new investors or deposit additional funds to “unlock” their accounts.

Redirection to Social Media Support: Legitimate platforms typically offer direct email or phone support; however, qdd-finance.com relies exclusively on Telegram handles. This method is a common scam tactic, offering no accountability or transparency.

Evidence of Fraudulent Activity

Transaction records linked to wallet address indicate rapid, large-scale transactions consistent with money-moving schemes. In addition, the site has amassed a high volume of cryptocurrency deposits, pointing to an organized scheme where funds are quickly moved to prevent recovery. - Domain Analysis and Red Flags

An investigation of the domain qdd-finance.com reveals several warning signs: - Recent Registration: The domain was registered only recently, aligning with the typical lifespan of scam sites that operate briefly before disappearing.

Minimal Online Presence: SEO analysis shows no significant backlinks or organic search traffic, indicating a lack of credible standing in the online finance community.

Hidden Hosting Details: The platform is hosted through a provider that shields the location of its servers, adding a layer of anonymity for the operators. The domain’s hosting structure, likely through Cloudflare or similar providers, obfuscates its true origin, a common strategy for scam sites.

How to Recognize and Avoid Similar Scams

To avoid falling victim to fraudulent schemes like qdd-finance.com, investors should be mindful of these red flags: - Unrealistic Profit Guarantees: Genuine investment platforms do not guarantee high returns, especially in the volatile crypto market.

Lack of Transparent Contact Information: Avoid platforms that only offer support through social media or lack a verified physical address.

Unverifiable Claims of Partnerships: Be wary of any platform claiming affiliations with major financial institutions or regulatory authorities if those affiliations cannot be independently verified.

Conclusion - Qdd-finance.com serves as a stark reminder of the risks associated with high-yield investment promises in the cryptocurrency sphere. As scams become increasingly sophisticated, it’s essential for investors to conduct thorough research, verify the authenticity of platforms, and approach all “too-good-to-be-true” opportunities with caution. By remaining vigilant and informed, investors can protect their assets from schemes designed to exploit their trust and eagerness for quick profits.

- You must be logged in to reply to this topic.