- This topic has 0 replies, 1 voice, and was last updated 1 year, 4 months ago by .

DigiFinex: Analyzing Alleged Scams and Victim Experiences

DigiFinex: Analysing Alleged Scams and Victim Experiences

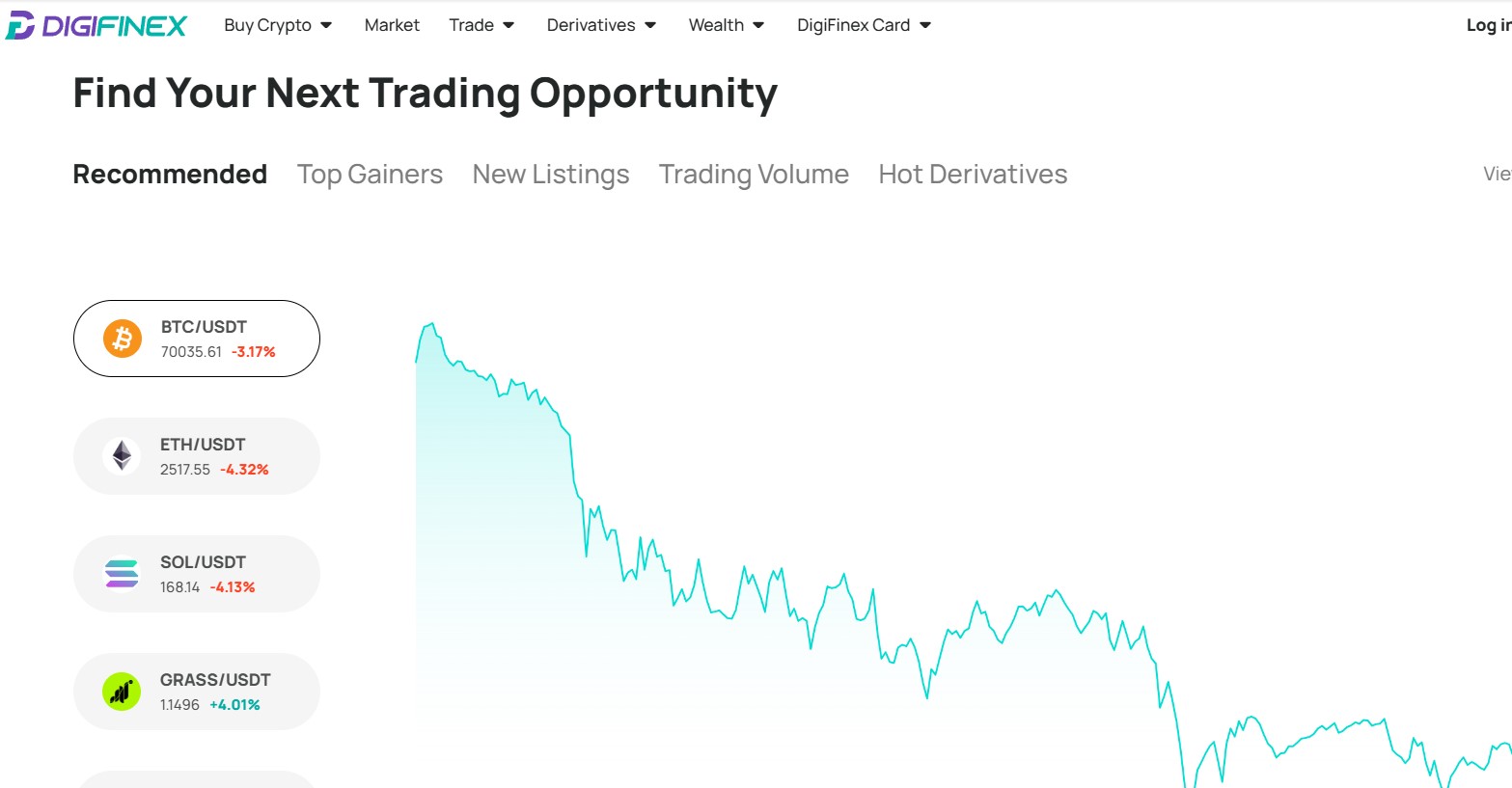

DigiFinex, a well-known cryptocurrency exchange, has allegedly used deceptive practices that have impacted users’ funds. DigiFinex questionable conduct and several reported cases of fraudulent and unethical practices have drawn the attention of regulators. Some users have reported significant monetary losses.

Overview of DigiFinex and Alleged Fraud Cases

This article examines incidents with DigiFinex and a second platform, Digital Surge, where they were reportedly involved in cases of inaccessible and locked funds. These platforms were also accused of miscommunication and lost transactions (connected to USDT (Tether) and other cryptocurrency transfers).

Case 1: Victim Loses $85,000 in USDT Transaction

A victim, who was not familiar with DigiFinex, claimed to have sustained a financial loss of $85,000. The victim could not withdraw their money from the platform. Initially, the individual attempted to transfer USDT coins from their DigiFinex account to a different exchange. However, they were told by the receiving platform that their deposit address (with DigiFinex) did not belong to them.

This error implies either a mistake in the transaction method or fraudulent involvement. Either way, it suggests that scammers were involved. These types of issues associated with USDT wallet verification, highlight the risks accompanying cryptocurrency wallet security and emphasize why it is imperative to verify addresses before initiating any transfer.

Security Risks and Address Verification

Cryptocurrency platforms generally recommend that users verify wallet addresses before they initiate any transactions. A clear address-verification process might have prevented an incident such as that noted above, where the user was unfamiliar with DigiFinex and lost a sizable sum of money. Although address errors can occur, the lack of adequate recovery methods put in place by DigiFinex raises a red flag. The lack of recovery processes is especially concerning when substantial funds are involved.

Case 2: Digital Surge (USDT) and DigiFinex Freezing Accounts

In another reported case, a user attempted to withdraw funds from Digital Surge and DigiFinex but was met with account freezes that restricted their access to their money. After repeated demands, their funds were unfrozen for a brief time. However, the money disappeared during the initial transaction. Following this event, customer support became unresponsive and none of the victim’s funds were recovered.

Unanswered Customer Support and Locked Accounts

Unresponsive customer service and locked accounts are typical characteristics of cryptocurrency scams. Crypto scammers use these tactics to restrict customers’ access to their accounts under the pretense of “freezing funds” or “verifying transactions”. Once the platform stops communicating with the individual and their funds remain inaccessible, victims are often left with limited or no options for regaining their lost funds. Furthermore, victims are often unsure whether the platform’s actions are legitimate security practices or intentionally deceptive measures.

Case 3: DigiFinex Withdrawal Issues and Account Freezes

In a third report, an individual claimed to have been actively trading on DigiFinex and attempted to withdraw their funds, totalling $123,000. Despite several attempts to follow-up on their correspondence with DigiFinex, the platform remained unresponsive. It is alleged that DigiFinex blocked the user from accessing their funds. Locked accounts without a logical explanation from customer support or recourse can point toward fraudulent activity. This is particularly true when the platform does not provide a resolution timeline or contact options.

Potential Misrepresentation Tactics

By not responding to customer queries or support requests, platforms like DigiFinex may appear to be engaged in tactics typical of fraudulent operations. The absence of transparent communication raises concerns among platform users and breeds distrust and dissatisfaction among clientele. This lack of transparency and support also calls into question DigiFinex’s commitment to secure and ethical operations.

Understanding Potential Scam Indicators

Lack of Customer Support

A lack of reachable customer support and unreliable support channels is a convincing indicator of fraud. In many of the cases explored above, the victims reported difficulty reaching customer support, particularly regarding matters involving frozen or inaccessible funds. Fraudulent platforms tend to intentionally deter users from pursuing customer support channels and from retrieving their assets.

Unresponsive Platforms and Delayed Withdrawals

Delayed or disregarded withdrawal requests demonstrate that a platform might be using deceptive methods. If an individual’s funds are unavailable for withdraw and no clear timeline is provided, the platform might be deliberately avoiding customer requests or exploiting transaction errors.

Risks Associated with USDT (Tether) Transactions

USDT transactions are commonly the focus of cryptocurrency scams because of the stablecoin’s extensive usage and capacity for high-value transactions. Given this, scammers might exploit USDT transfers. Users are also more likely to retain large sums of Tether for trading purposes, making USDT transfers an attractive target for scammers.

Seek Advice from a Cyber Forensic Expert Company for Recovery

If you or someone you know has suffered a significant financial loss, consult a crypto recovery specialist. If you have evidence of deceptive practices or misrepresentation, report the platform and the issues straightaway to a cyber forensic expert company. Also, remember to secure your accounts immediately.

Conclusion

While DigiFinex is a familiar name in the crypto market, recent reports suggest issues with support, transparency, and secure fund handling. The cases reported in this article reveal potential deceptive practices that emphasize the importance of user vigilance and security practices when trading on any crypto platform. These incidents highlight the need for secure, transparent cryptocurrency transactions and reliable customer support to help protect users from significant crypto scams.

- You must be logged in to reply to this topic.